test

The employees in the following classifications are eligible for district-sponsored health benefits:

All Gavilan Employees:

- Employee Assistance Program (EAP)

- Confidential counseling and support services View EAP Brochure

Full-Time Classified, Confidential, Management, and Faculty

Medical, Dental, Vision, Life, 403(b), 457, CalPERS, CalSTRS

- Medical Insurance- Open Enrollment: August 1st- 31st (Changes take effect January 1st)

- Dental, Vision, and Life Insurances- Open Enrollment: October 15th - December 13th (Changes take effect October 1st )

Part-Time Faculty

Medical Insurance (6-month), 403(b), CalPERS, CalSTRS

Biannual Open Enrollment Deadlines: January 15th & July 15th

Part-Time Faculty Health Insurance Program

Temporary/Substitutes/Part-Time Classified and Confidential

APPLE Plan – retirement savings plan with direct payments through payroll

APPLE Plan Introduction Packet

Through our insurance broker, Self-Insured Schools of California (SISC), Gavilan Joint Community College District provides medical coverage plans to all full-time employees as well as eligible part-time faculty. Gavilan College has adopted the California Community Colleges Chancellor's Office Program to support our part-time faculty in gaining access to affordable medical insurance.

Medical Insurance Option 1:

Anthem Blue Cross, PPO | Anthem Blue Cross - Classic [Full] Network | ||

| 100 | 90/10 | 80/20 |

| Anthem Blue Cross - Select Network | |

| 100 | 80/20 |

Medical Insurance Option 2:

Kaiser Permanente, HMO

Learn More - Medical Benefits:

PREMIER PLAN

Extensive network of dental providers and coverage options. Members will not receive a membership card

DIAGNOSTIC, PREVENTATIVE, AND BASIC SERVICES- Cast and Crown Services

- Endodontics

- Periodontics

- Oral Surgery

*70% of the above billable services are covered by Delta Dental Insurance for the first year of active membership. The coinsurance percentage will increase by 10% each year (to a maximum of 100%) for each enrollee if that person visits the dentist at least once during the year.

Signature Plan

Comprehensive vision coverage including eye exams, glasses, and contact lenses. Members will not receive a membership card.

INCLUDED ANNUAL SERVICES: EXAMINATION LENSES FRAMESCovered Services

- Eye Examination ($20 Copayment)

- Consultations ($20 Copayment)

- Urgent/Emergency Care ($20 Copayment)

- Special Ophthalmological Services

- Eye and Ocular Adnexa Services

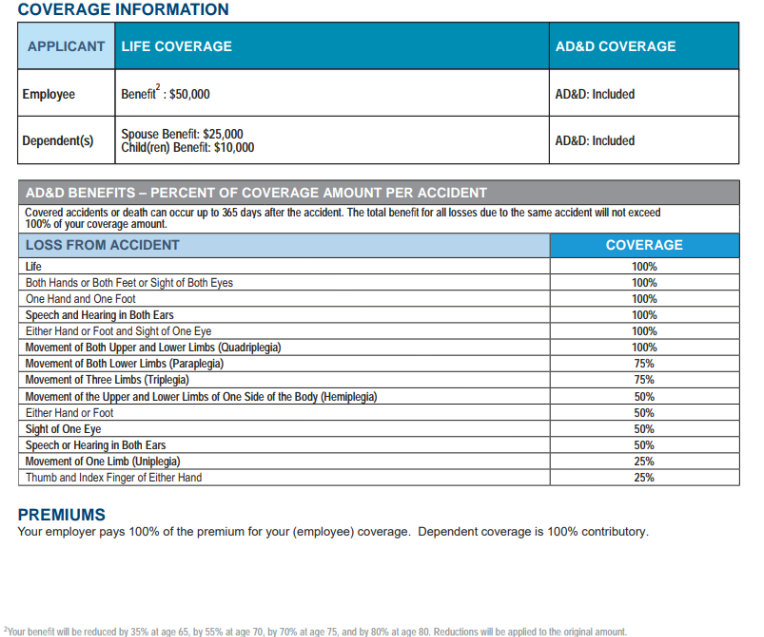

Secure Your Future with Hartford Life and AD&D Insurance

Reliable life insurance coverage to provide peace of mind to you and your family. Life insurance enrollment is standard for all regular full-time employees.Additional coverage options are available for eligible dependents.

| Life Insurance Coverage: | Monthly Premium Cost |

|---|---|

| Employee Only | $ 13.51 |

| Spouse/Domestic Partner | $ 6.74 |

| Child Dependent | $ 1.41 |

| Retiree | $ 42.12 |

403(b) - Tax Sheltered Annuity Plan

| 2023 | 2024 | |

|---|---|---|

| Employee pre-tax and Roth contributions* | $ 22,500 | $ 23,000 |

| Employee “lifetime” (“15 year” or “special”) catch-up contributions ** | $ 3,000 | $ 3,000 |

| Maximum annual contributions*** | $ 66,000 | $ 69,000 |

| Age 50+ catch-up contributions* | $ 7,500 | $ 7,500 |

No district contribution match. Your choice of vendor(s) through: 403bCompare

*This limit includes such contributions to all 401(k), 403(b), SIMPLE, and SARSEP plans at all employers during your taxable year. Contributions to 457(b) plans, if any, are disregarded. Age 50+ catch-up contributions apply if allowed by your plan and you will have attained at least age 50 during your taxable year. Depending on plan rules, age 50+ catch-up contributions may also be made on a pretax or Roth basis.

**403(b) plans of "qualified organizations" may also allow what is known as a "lifetime," "15 year," or "special" catch-up, which must be exhausted before using the age 50+ catch-up. Both catch-up contribution types can be used in the same taxable year if eligibility requirements for both are met. The lifetime catch-up may be available at any age upon attaining 15 years of service with the 403(b)-plan sponsor which is a qualified organization. A formula determines the maximum catch-up amount based on contributions in prior years. Total lifetime catch-up contributions in all years are limited to $15,000. Depending on plan rules, lifetime catch-up contributions may be made on a pretax or Roth basis.

***This limit includes all "annual additions," such as employee pretax and Roth contributions, employee after-tax contributions, as well as any employer contributions (e.g., match, nonelective) and re-allocated forfeitures. Age 50+ catch-up contributions, whether made on a pretax or Roth basis, are not "annual additions," so do not count towards this limit. Contributions are generally limited to the lesser of100% of your compensation or this number, but there are some church plan exceptions, and your plan may otherwise limit this; please refer to your plan's materials for other applicable limits.

457 - Deferred Compensation Plan: Public & Nonprofit Workers' Retirement

| 2023 | 2024 | |

|---|---|---|

| Employee and employer contributions* | $ 22,500 | $ 23,000 |

| Double limit catch-up contributions (3years before “normal retirement age”)** | $ 22,500 | $ 23,000 |

| Age 50+ catch-up contributions*** | $ 7,500 | $ 7,500 |

If employee is contributing a minimum of 1% of their paycheck, Gavilan District with match up to 1%.

*The limit is the lesser of the dollar amount shown, or 100% of your includible compensation for the taxable year. This limit includes contributions to all 457(b) plans (governmental and nongovernmental) at all employers during your taxable year, including any employer contributions (and earnings thereon) that vest during the year. Contributions to non-457(b) plans (such as 401(k) and 403(b) plans) are disregarded. Depending on plan rules, employee contributions to a governmental 457(b) plan may be made on a pretax or Roth basis.

**Eligibility occurs during the three taxable years ending before the employee attains "normal retirement age" as defined by the plan. Eligibility requires the availability of an "underutilized amount" based on plan contributions in preceding years. Depending on plan rules, double limit catch-up contributions to a governmental 457(b) plan may also be made on a pre-tax or Roth basis.

***The limit includes age 50+ catch-up contributions to all governmental 457(b) retirement plans at all employers during your taxable year. Age 50+ catch-up contributions to 401(k) and 403(b) plans are disregarded for the 457(b) limit. Age 50+ catch-up contributions apply if allowed by your plan and you will have attained at least age 50 during your taxable year. Depending on plan rules, age 50+ catch-up contributions to a governmental 457(b) plan may also be made on a pretax or Roth basis.

If you are eligible for both the age 50+ catch-up and the double limit catch-up, you cannot take advantage of both limits, but you are entitled to the greater of the two.

457 Representative: Nancy Garrity, CRC, Nancy.Garrity@voya.com, 888-713-8244 Opt. #2

Standard Retirement Plans: CalPERS & CalSTRS

CalPERS - Classified Employees 2024 Contributions:

- 7% Employee Classic Contribution

- 26.68% Employer Contribution

- 8% PEPRA

- 2% at 55 OR 2% at 62 (if member after 01/01/2013)

- CalSTRS eligible employees may elect CalPERS retirement IF previous CalPERS member.

CalSTRS - Active Faculty 2024 Contributions:

- 10.25% Employee Classic Contribution

- 19.1% Employer Contribution

- 10.205% PEPRA

- 2% at 60 OR 2% at 62 (if member after 01/01/2013)

- All faculty positions qualify for either optional or mandatory CalSTRS retirement enrollment.